Brazil Bets hits R$17bn GGR as tax and ad judgements loom

Ana Maria Menezes reports on the first six months of Brazil’s Bets market, where official statistics highlight positive revenues and tax generation, reinforced by measures on responsible gambling and a crackdown on illegal operators. However year-end anxieties grow as Congress weighs tax rises and tighter advertising rules.

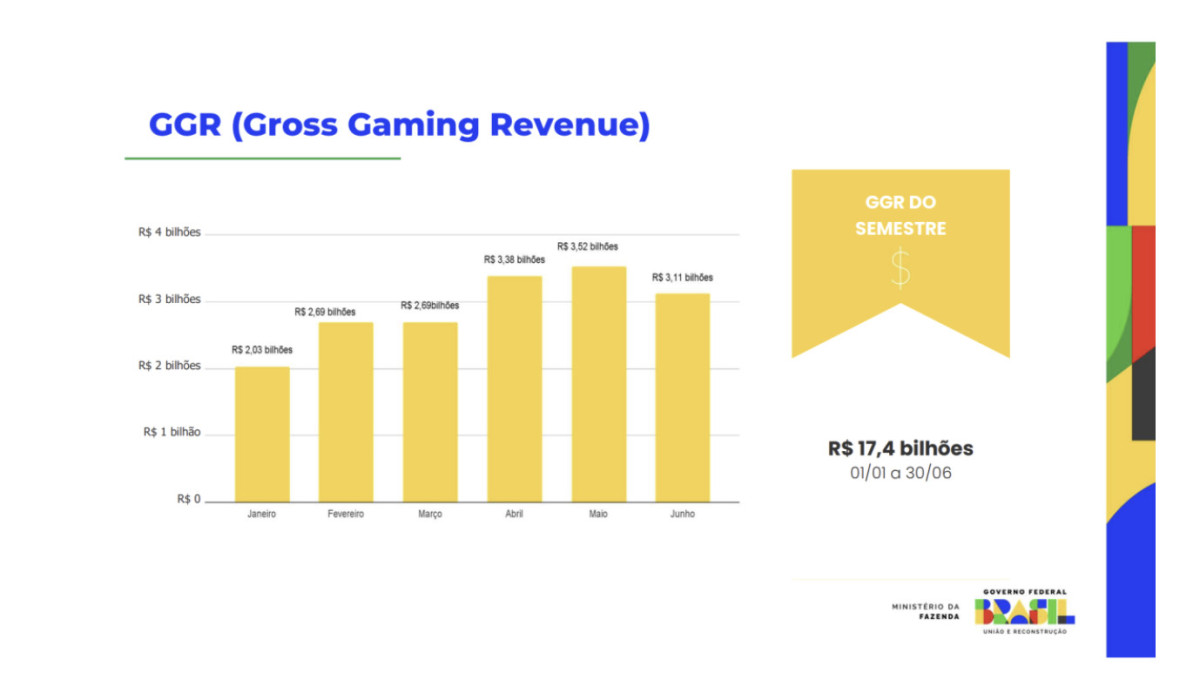

Brazil’s Ministry of Finance has unveiled the first half-year figures for the Bets regime for online gambling, confirming gross gaming revenues (GGR) of R$17.4bn (€3.1bn) between January and June 2025.

According to the update, disclosed yesterday by the Secretariat of Prizes and Betting (SPA), the activities of licensed operators contributed R$3.8bn (€670m) in federal taxes, alongside R$2.14bn (€380m) channelled towards social projects under the 12% levy set by Law 14.790/23.

A further R$2.2bn (€390m) was collected in upfront authorisation fees, with R$49m (€9m) raised in regulatory charges. Via tax agency Receita Federal, the Ministry had already published its first tax taking of Bets licences in its June economic update.

Bets Metrics & Composition

By the close of the period, 78 authorised companies were active, representing 182 brands monitored by the SPA. The Betting Management System (SIGAP) logged 17.7m Brazilians placing bets in the first six months of the year.

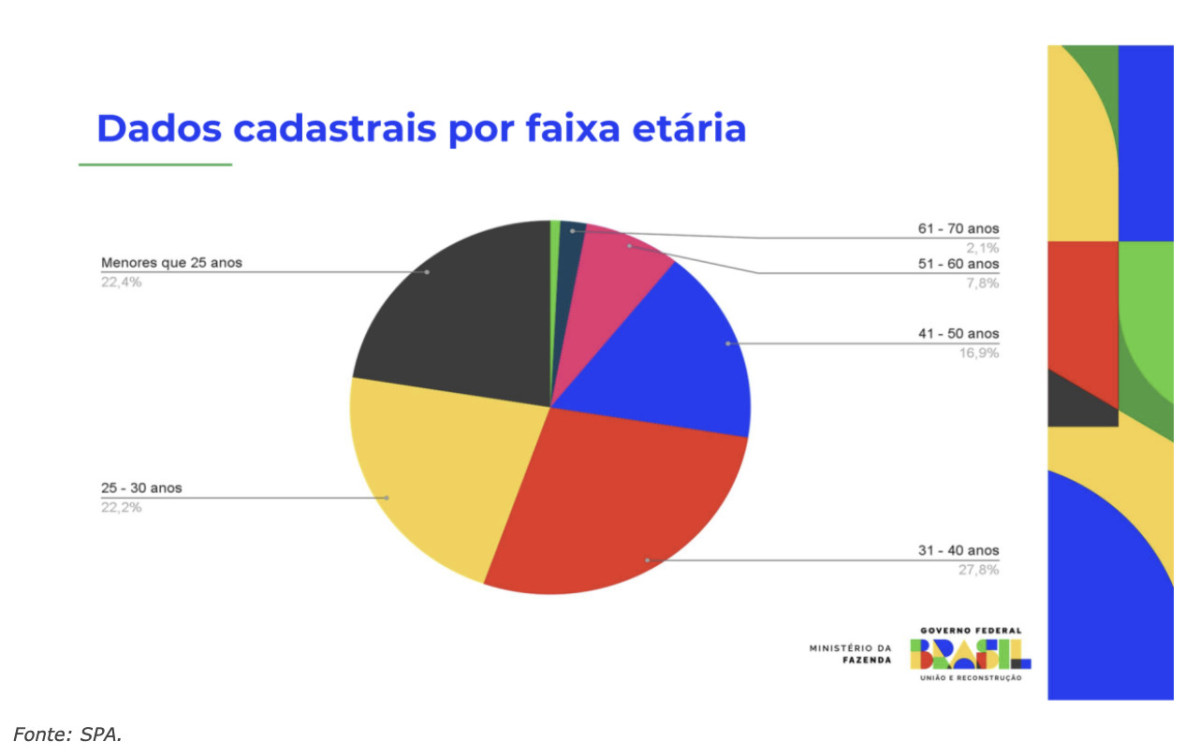

The demographic skew is overwhelmingly male, with men making up 71% of bettors versus 28.9% female participation. By age, the strongest cohort is 31–40 year-olds (27.8%), followed by 18–25 (22.4%) and 25–30 (22.2%). Average spend per active bettor was calculated at R$983 for the half-year, or R$164 per month.

‘Responsible Play’ measures take hold

SPA flagged progress on responsible gambling initiatives, which now require warning messages across all advertising, a ban on under-18 targeting, and the option for players to set deposit and staking limits.

Alongside these rules, an inter-ministerial taskforce has rolled out a wider prevention plan, spanning health self-assessment tools, a centralised self-exclusion registry, medical protocols and athlete-focused awareness campaigns.

June saw the creation of a committee to structure the National Betting System (SINAPO) — a federal-state platform that will host a unified list of licensed operators and grant access to the exclusive .bet.br domain.

Clampdown on illegal sites

The SPA has sharpened its offensive against the multi-billion-real black market that continues to siphon players away from licensed operators. Since October 2024, telecoms regulator Anatel has blocked more than 15,400 illegal betting websites and pages, targeting offshore operators and mirror domains that evade consumer protections and taxation.

The crackdown has extended deep into Brazil’s financial system. Working alongside the Central Bank, the SPA identified suspicious transaction flows and pressed banks and payment providers to act.

In the first half of 2025 alone, 24 institutions reported 277 suspect cases, resulting in the closure of 255 accounts linked to unlicensed gambling. Regulators said the move sent a “clear warning” that financial infrastructure cannot be used to prop up the shadow economy.

Digital platforms have also come under the spotlight. A partnership between SPA and the Brazil Digital Council comprising Google, Meta, TikTok, Kwai and Amazon fast-tracked the removal of 112 influencer pages and 146 illegal ad placements promoting offshore operators. Officials described it as a crucial step in tackling the “ecosystem of promotion” that fuels demand for black-market play.

The SPA continues to revise its strategy against unlicensed operators, in which it will continue to coordinate enforcement with the help of Brazilian banks, telecoms and Big Tech platforms.

Advertising overload under scrutiny

Following the first six months of Bets activities, both the Senate and Congress have detailed concerns about the relentless advertising coverage of betting operators across Brazil’s media and sports landscape.

Television broadcasts of the country’s top-flight football, shirt sponsorships, and a constant stream of influencer-led social media campaigns have fuelled complaints from parents’ groups, health advocates and lawmakers that betting has become “unavoidable” for young audiences.

SPA Secretary Regis Dudena acknowledged that advertising intensity has reached levels that may require intervention. In an interview with Folha de São Paulo’s C-Level videocast, he stated:

“When people criticise, they are often looking at stadium activations, football club shirts, TV commercials. At some point this may need to be controlled more closely, with some restrictions.”

A raft of new proposals have been submitted to congress with the majority urging a ban on active athletes from appearing in operator campaigns and whether to restrict endorsements from public figures more broadly.

Brazilian football warns against overly restrictive measures, with industry figures cautioning that sweeping bans risk dismantling the sponsorship structures that keep many clubs financially afloat through bookmaker partnerships.

Bets Tax settlement

The future tax framework remains the sharpest point of debate. In June 2025, the federal government issued Provisional Measure No. 1,303/2025, which raised the GGR levy on licensed operators from 12% to 18%, effective from 1 October 2025.

The measure took effect immediately on publication but must still be ratified by Congress to become permanent. A joint congressional committee has been formed to review the law, with votes and public hearings scheduled. As of mid-July, the temporary provision was extended until 8 October, when legislators will decide whether to confirm the higher rate.

Industry trade groups have cautioned that raising the Bets licence tax to 18% risks giving an edge to illegal operators, warning that licensed firms are still adapting to Brazil’s evolving regulatory framework since January’s launch.

As year-end draws to a close, attention focuses on Brasília, where Congress and the Senate must decide whether to ratify higher taxes and tighten advertising rules or leave operators navigating a state of regulatory limbo in Brazil’s multi-billion-real online gambling market.

No Comments