EY warns of economic risks of overstated UK gambling tax treatments

EY believes that the UK government has overstated the value of different tax proposals on gambling submitted to HM Treasury as part of the Autumn Statement Budget to be delivered on 26 November.

Commissioned by the Betting and Gaming Council (BGC), the Big-Four accountancy firm undertook an independent review of all gambling tax scenarios currently under consideration by Rachel Reeves, Chancellor of the Exchequer.

In its report “Tax Treatment of Remote Gambling”, EY examines how proposed reforms to betting and gaming excise duties would affect Treasury receipts, gross value added (GVA), employment, and the size of the UK black market. The firm warns that “current government models fail to reflect the behavioural and economic responses that would follow significant tax increases.”

EY notes that the Treasury’s approach relies on static cost projections that “overstate the fiscal benefit of higher duties by ignoring how consumers and operators are likely to react to price changes.” The report adds: “Higher duties risk diminishing fiscal returns once consumer responses, regulatory headwinds and black-market displacement are properly considered.”

Under the so-called “general alignment” scenario — equalising all remote gambling taxes at 21% — EY projects that the measure would raise around £250m in additional receipts, but at a cost of £240m in lost GVA and up to 3,000 jobs across the regulated market and its supply chain. Even moderate reform, the firm cautions, could “expose the regulated sector to black-market encroachment in the range of £400m to £1.2bn in diverted stakes.”

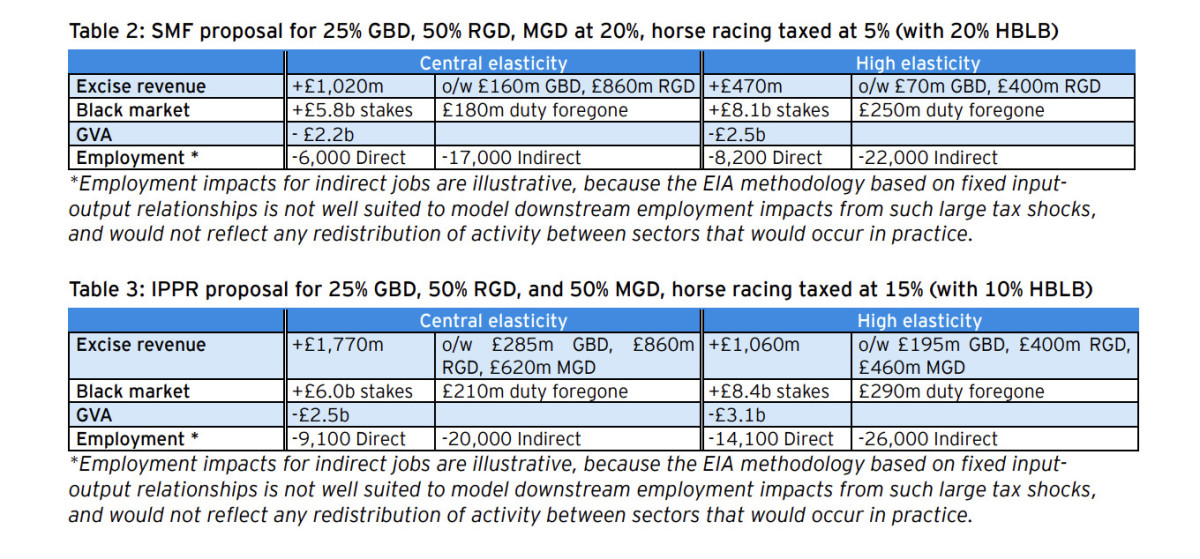

The most severe warnings are reserved for the Social Market Foundation (SMF) and Institute for Public Policy Research (IPPR) models, which propose doubling the Remote Gaming Duty (RGD) to 50% and increasing General Betting Duty (GBD) to 25%.

EY calculates that while the SMF model might increase excise revenues by around £1bn, the wider economy would lose £2.2bn–£2.5bn in GVA and as many as 30,000 jobs. “The key reason for the smaller expected increase in excise revenues in our analysis,” EY explains, “is that we allow for a behavioural response from consumers, whereas SMF and IPPR conclusions appear to assume no change in behaviour from higher prices.”

The IPPR’s framework, regarded as the most punitive, would raise all main duties—including Machine Gaming Duty (MGD)—to between 25% and 50%. EY concludes that such a move could “shrink industry GVA by as much as £3bn and erase tens of thousands of jobs,” while driving £6bn–£8bn in betting stakes offshore and resulting in up to £290m in foregone UK duty.

EY further reminds policymakers that the 2026 baseline already reflects the government’s “High Stakes: Gambling Reform for the Digital Age” package, which is expected to reduce remote gaming GGY by £725m by 2026. “Further tax rises would therefore fall on an industry already adjusting to a materially tighter regulatory environment,” the report states.

Concluding its findings, EY advises the Treasury to “consider the full economic footprint of the gambling sector,” including employment, supply-chain taxation and consumer switching effects. While small adjustments could deliver a short-term uplift in receipts, the firm warns that “aggressive escalation in betting and gaming duties would prove counterproductive—shrinking the sector’s contribution to the UK economy and widening the reach of the black market.”

No Comments