Nicolas Béraud: Banijay Gaming grabs Western Front of Euro gambling

“Betclic and Tipico share a common understanding of how to operate in highly regulated environments and this is a strength,” states Nicolas Béraud, Chairman of the new Banijay Gaming unit.

Jake Pollard breaks down the numbers and prospects of a new giant and its direct impact on the competitive make-up of European gambling.

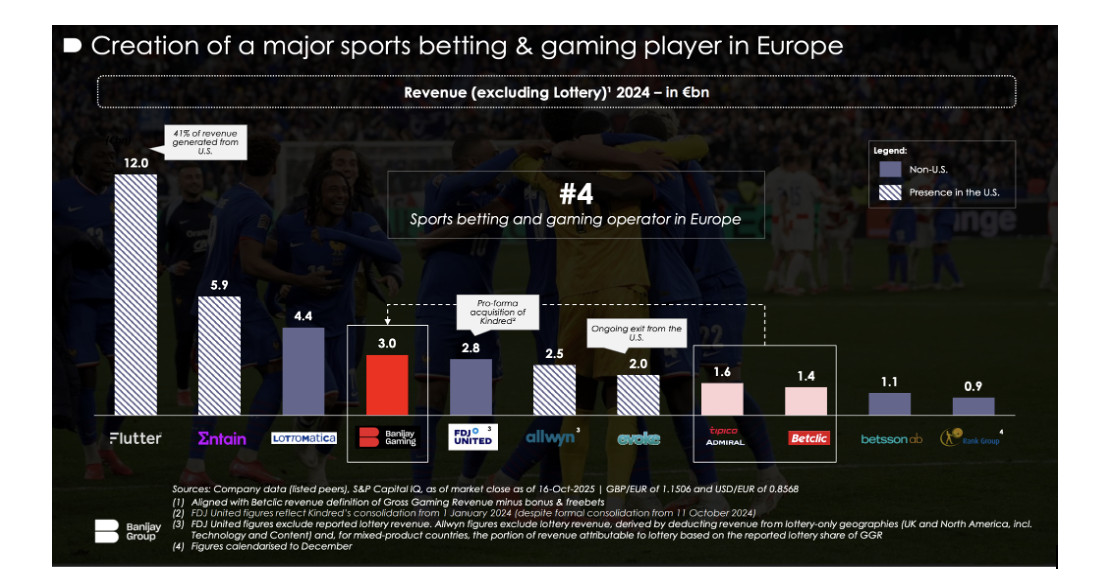

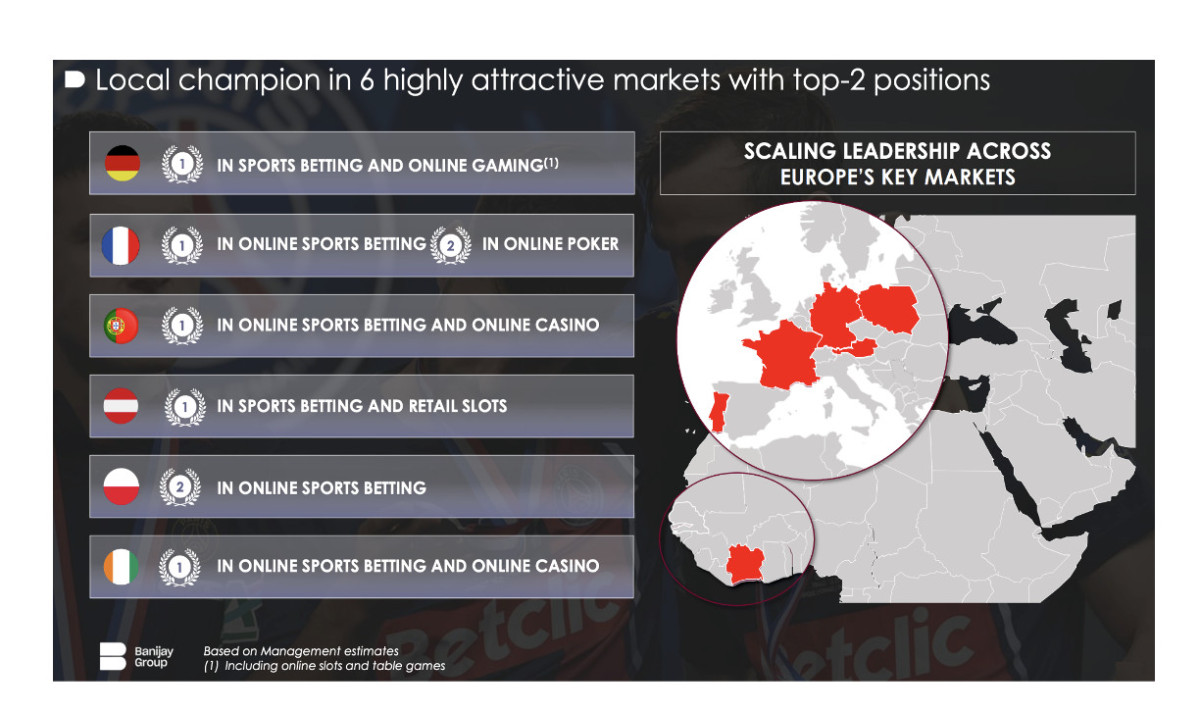

The acquisition by Betclic’s parent company Banijay Group of a 65% stake in Germany’s leading bookmaker Tipico has redefined the European online sports betting industry and means France can now boast of having two operators in the top five of Europe’s leading gaming operators.

The agreement was announced yesterday (Tuesday) and SBC-Gaming&Co spoke with Betclic founder and CEO, and now chairman of the board of Banijay Gaming, Nicolas Béraud, to find out what this “new European champion in sports betting and online gaming” has planned and how it intends to drive on from here.

The new entity has more than 6.5 million players, is present in six countries and has revenues of more than €3bn and, as Beraud notes, the agreement features numerous benefits for both groups. “By combining the strengths of Betclic, Tipico and Admiral, we are creating a digital and omnichannel group that is stronger and more resilient,” he said

“It also diversifies our geographical risks and gives us the means to accelerate our development and strengthen our position in sports betting, our core business. We are entering a new phase in our journey: that of a European group focused on sustainable growth.”

An observation that is often made about Betclic is that it has been highly successful in highly regulated and taxed markets such as France, Portugal and Poland. How did this background impact its decision to invest in Tipico, which also operates in a tightly controlled and restricted German market?

Giant to move beyond home comforts

“Betclic and Tipico share a common understanding of how to operate in highly regulated environments and this is a strength: this rigour drives us to be better, more innovative and more responsible,” Nicolas Béraud

Germany’s federal structure may also add a layer of complexity, but the group has “the experience and teams to operate in this type of environment, while maintaining the highest standards of compliance and player protection”, he adds.

Tipico, unlike Betclic, is very much centred on ‘home’, or German-speaking, markets. Can we expect further expansion or launches in other European markets or more M&A activity by Betclic in the future?

“Our immediate priority is the convergence and stability of our three organisations. But we have always had an entrepreneurial culture: when the fundamentals are solid, we naturally look towards growth. In the medium term, the group has always clearly stated its intention to open up new growth opportunities in Europe and other continents.”

It’s impossible not to mention the black market when discussing Germany, how will Béraud and his new colleagues tackle the issue? “The illegal market remains a real issue in Germany, as it does in France and Poland. When regulations are too restrictive, players turn to unauthorised platforms, which are accessible in just a few clicks,” he remarks.

“Tipico is now the leading player in the German legal market, with more than 1,250 licensed outlets and strong legitimacy with the authorities. It would be a trusted player in the context of more open regulation of the German online casino market.

“We hope that the new German coalition’s stated intention to tackle the illegal market will quickly translate into action. Clear and enforced regulation is the best guarantee for protecting players and bringing lasting stability to the market.”

Returning to France, Bet365 is set to launch in the market before the 2026 World Cup. Does this make it the perfect time for Betclic to become a pan-European giant in terms of market share, competitiveness and financial power?

“The possible arrival of new players such as Bet365 does not change our trajectory,” he says, but he also notes that France being “highly regulated and heavily taxed automatically limits our room for manoeuvre, while current budget debates seem to show that fiscal stability is clearly not yet a reality in France. Expanding internationally is therefore a necessity, not an option.”

Indeed, Betclic’s latest agreement comes at a time when European markets are entering a phase of consolidation and, with moves including Entain’s buyouts of STS in Poland and Flutter acquiring Snai in Italy, “several major M&A transactions taking place in our industry over the past five years, giving rise to increasingly large operators. This must be taken into account,” adds Béraud.

“Thanks to our new size, we are gaining investment power, technological agility and marketing strength. This will enable us to continue innovating, promoting responsible gaming and offering the best possible experience to our players.”

The numbers game…

Banijay, Europe’s largest entertainment and media production firm, has agreed to acquire a majority 65% stake in Tipico from private equity owners CVC Capital and the bookmaker’s founders. The new entity will combine the Betclic, Tipico and Admiral Austria brands and establish a group with 2024 revenues of €3bn and adj. EBITDA of €850m.

- Banijay CEO François Riahi said “Tipico fits perfectly with our DNA – a strong leader in two regulated markets, highly profitable and product-focused. This deal provides Banijay with the reach, scale and diversification that already define our content business.” Tipico is Germany’s leading sports betting and gaming operator, with revenues of €1.3bn in 2024. It acquired Admiral Austria in September 2025, the latter delivering €346m in revenues in 2024.”

- Banijay said it will seek to grow its controlling stake in Tipico to 72% via the purchase of further equity from CVC Capital. The founders of both Betclic and Tipico will roll over their equity and remain long-term shareholders in Banijay Gaming.

- The transaction is backed by a €3bn financing package to refinance Tipico’s existing debt, bringing Banijay’s group leverage to 3.5x, with a target to fall below 2.5x within three years.

- The merger will deliver €100m in annual synergies through product innovation, platform efficiencies and shared procurement. As part of the move Betlic COO Julien Brun becomes CEO of Betclic, while Axel Hefer remains CEO of Tipico and Joachim Baca is named Vice-Chairman of the Banijay Gaming board.

No Comments